Banking organizations worldwide are rapidly scaling transformation efforts to help their organizations compete more effectively in an increasingly digital world. While the largest organizations have invested heavily in changing business processes, products, and the use of technologies for years, smaller organizations are playing catch-up, rushing to serve the digital needs of consumers unable or less likely to access branches during the pandemic.

Many financial institutions know that becoming a more digitally adept organization is imperative to future success but nevertheless, struggle to act on this growing awareness. Adding to this challenge is the reality that most employees at financial institutions feel ill-equipped to support digital transformation initiatives. When employees are not kept abreast of changes and trained to support new digital demands, they feel that their jobs may be at risk and are likely to undermine those changes as a matter of survival.

Both legacy leadership and the lack of employee engagement have negatively impacted the ability of organizations to increase their data maturity. In post-pandemic banking, that’s a big problem. The ability to effectively collect, analyze, and deploy data drives all digital transformation. How nimbly a financial services institution can use data as a strategic business asset will determine whether a banking organization thrives in the future or folds in on itself, unable to meet the demands of an older and data-wiser world.

Data maturity takes center stage

Data alone is not an asset. It’s what is done with data that counts. And this is where data maturity comes into play. Data maturity is the extent to which an organization uses its data for improved decision-making and customer experiences. The more highly data is esteemed, and the more sophisticated the techniques to analyze the data are, the more data-mature the organization is. Likewise, an organization that does little with the data it produces is likely to only be in the very early stages of its data maturity journey.

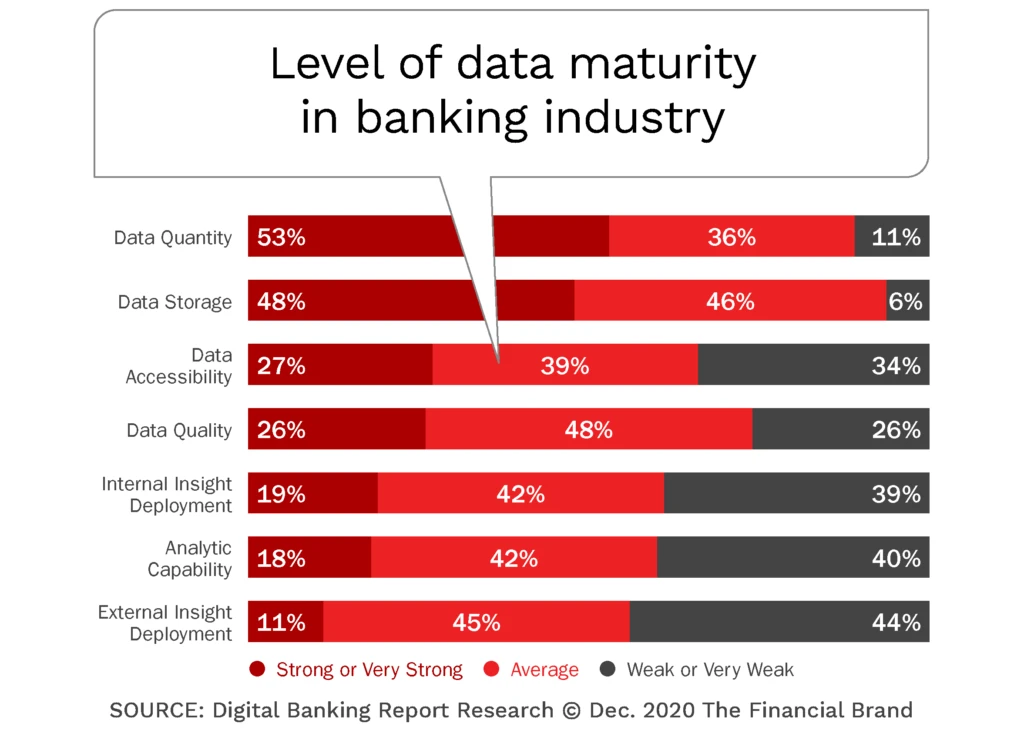

Research by Digital Banking Report shows that most financial institutions did not rank themselves very highly regarding data maturity. While most organizations appeared to be comfortable with data quantity and the ability to store data, the level of maturity plummeted for all other major data components, including accessibility (only 27 percent of organizations ranked themselves strong or very strong), quality (26 percent), internal insight deployment (19 percent), and analytic capability (18 percent).

These measures of data maturity were reinforced when we asked about the availability of data to improve the customer experience or the availability of data from a single source. The reason we measured the availability of data to improve CX is that moving data objectives from inside the organization to outside experiences is where the real power of data is achieved. In our analysis, only 12% of organizations believed they had the level of data and analytics needed to drive a positive experience.

Finally, without a single source of data, it is difficult for an organization to establish the requisite trust for a strong data strategy. Only 6 percent of organizations surveyed stated they had a single source of insights. This illustrates that most organizations would fall into the “data-aware” or “data-proficient” stages of data maturity as opposed to being “data-driven.”

Main contributors to low data wisdom

While virtually all financial institutions list “improving the customer experience” at the top of their priorities for the past five years as well as for 2021 and beyond, less than 25 percent say they are adept at using customer insights to build contextual offers that are timely and actionable. This limits the capacity to optimize customer experience or maximize enterprise value. In a post-pandemic world where the consumer now understands the extent to which organizations can make their life easier with data and applied insights, this gap between what’s possible and what’s experienced will negatively impact success.

Technical and organizational issues both contribute to the challenges faced by financial institutions. According to our research, the primary blockers for the development of a better data management process differ based on asset size. While difficulty in extracting data and insights from the platform was a key challenge for both small and large organizations, the level of difficulty was much greater for smaller institutions (as was the availability of skilled talent). Both large and small organizations also indicated a lack of cooperation or unified view across the organization.

We found that financial institutions in the early stages of deployment (or those not yet deploying a solution) were the most likely to cite organizational, budget, and leadership issues as obstacles. Those banks and credit unions further along in the deployment process tended to cite more technical hurdles.

Having a lot of data is not the goal. The goal is to collect, collate, manage, process, and deploy data that provides a unified and accurate view of the customer in a way that all parts of the organization can use. Rather than multiple data silos being used by different parts of the organization, decisions should be made using a single set of information. A data-driven organization achieves a higher level of operational efficiency, adapting to changes quickly and meeting customer demands with more precision.

Commitment to data sense lacking

As with many areas of digital banking transformation, financial institution executives understand the importance of progressing—quickly—to a higher level of data maturity. In fact, the level of importance placed on improving data quality and analytic capability produced some of the highest scores we have seen in a post-pandemic world.

Unfortunately, this understanding has not yielded the level of commitment necessary for improving data maturity within organizations. There is a concern around the rather low level of importance placed on the ability to deploy insights across the entire organization.

And not all organizations are investing in making sense of data at the same pace. The largest financial institutions surveyed increased their budgets for data and analytics significantly more than smaller organizations. Smaller organizations did increase their budgets, but not nearly as aggressively.

Those organizations that commit resources to improve their application of data will be the ones that thrive. They’ll be ahead of other financial institutions in addressing both immediate challenges caused by the pandemic and in taking advantage of opportunities going forward. Consumers want to work with organizations that provide value for the data they provide. Today, financial institutions of all sizes can compete—and they must.

Using data to proactively offer products and services beneficial to customers in real-time is a new power. Banks’ and credit unions’ readiness to understand and exercise this power will determine their success in a world that now expects it.

Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar). Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.