Today in the Insurance Industry, Customer experience is a big focus for businesses. Customers have more choices than ever, and they are looking at a value beyond the features of the product itself to the entire experience, including the evaluation, purchase, and post-purchase steps.

The evolution of the customer experience means that customers expect to be able to reach your company in any way they choose. Customers often start their contact with your company through a self-service experience, then interact through one of several live channels to purchase, and then they may interact with your company through both live and self-service channels for service.

Omnichannel is the industry term that describes this have-it-my-way support experience that customers demand. Call centers, which have evolved from phone-only support to channels that can support any type of live-assistance, are now often called contact centers.

However useful omnichannel is to serve customers, it reflects a fundamental shortcoming: It assumes that a series of successful customer interactions will result in a satisfied and loyal customer. Customers are not interactional, but rather transactional. A transactional customer needs a different experience. Microsoft supports an always-on customer experience, an experience that organizes the best of omnichannel in line with each customer journey. Always-on customer engagement represents the evolution of omnichannel that treats each customer journey as a single transaction made up of a series of multichannel interactions.

This leads to the insight that customers want, and companies need to create, an entirely new experience, one that leads to customers who are not only happy with their purchase but also loyal to the company that was able to deliver it. Always-on customer engagement supports the customer by engaging when they want, in their preferred contact channel. It’s fundamentally aligned to each customer’s unique needs for every interaction. Contact center agents who support customers in all their live interactions will have additional support in meeting customers’ needs efficiently and effectively. Managers will have the information they need to make decisions to better support customers and serve the needs of their agents.

Consider an insurance customer who has a car accident and files a claim. The claim may start with a mobile application that captures the key details. Once the claim is submitted, an agent calls to take a statement and gather any additional relevant information. The customer may make multiple inquiries regarding the status of their claim by phone or email or by checking within the app for updates. Once the claim is processed, the customer engages with a repair center. Finally, once the repair has been completed, they receive a survey to check on their experience.

The general process is probably similar to your competitors’, so how can you enrich and improve each touch? Each step is an opportunity to lower costs, improve customer outcomes, and set your company apart. Always-on customer engagement provides your company with a path to competitive advantage as the customer experience becomes an increasingly important part of your overall value proposition.

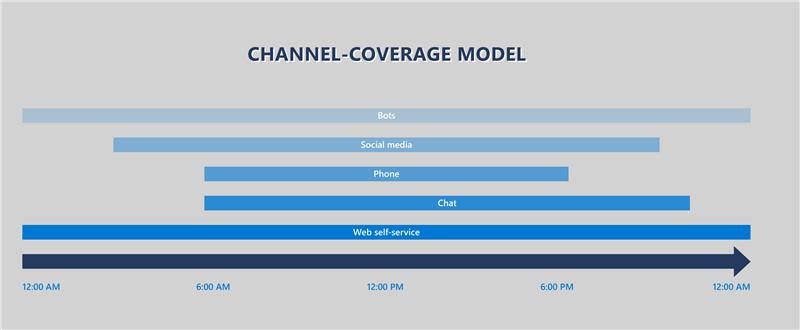

In designing an always-on customer experience, companies also face the reality of fitting their aspirations within their budgetary constraints. Every customer touchpoint generates data, and that data guides the remainder of the customer’s experience and provides a chance to make sure transactional needs are being met. Think of the challenge as a channel-coverage model.

Your company may opt for more self-service channels during low-traffic times and more live assistance channels during peak times. This allows an efficient balance between high-value live assistance delivered primarily through contact centers and lower-value assistance delivered through the web and other self-service channels.

This is the first of a series of articles exploring the concept of always-on customer engagement and how it impacts each of your key stakeholders: customers, contact center agents, and managers. At the core of success in always-on customer engagement is a robust ability to capture and leverage relevant data. This series will explore how companies can transform these data into insights to improve customer experiences from all perspectives in a landscape of new expectations.

Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner with offices all over GCC (Bahrain, Saudi Arabia KSA, Oman “Muscat”, UAE “Dubai”, and Kuwait), with domain expertise in Financial Services Sector Digital Transformation like” Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking.