AI is going to transform the finance function. This common platitude is typically backed with little or no substance. However, when addressing common financial challenges, the opportunities for transformation become abundant. Workstreams are often hindered by legacy technology and traditional processes. Employees are expected to work quickly and accurately, but have a huge workload of manual, repetitive, and sometimes unnecessary tasks. These tasks then lead to a focus of time and resources on transactional work with a little leftover for adding value. D365 Finance Insights, a set of AI-powered capabilities coming to D365 Finance, will enable this shift for several processes.

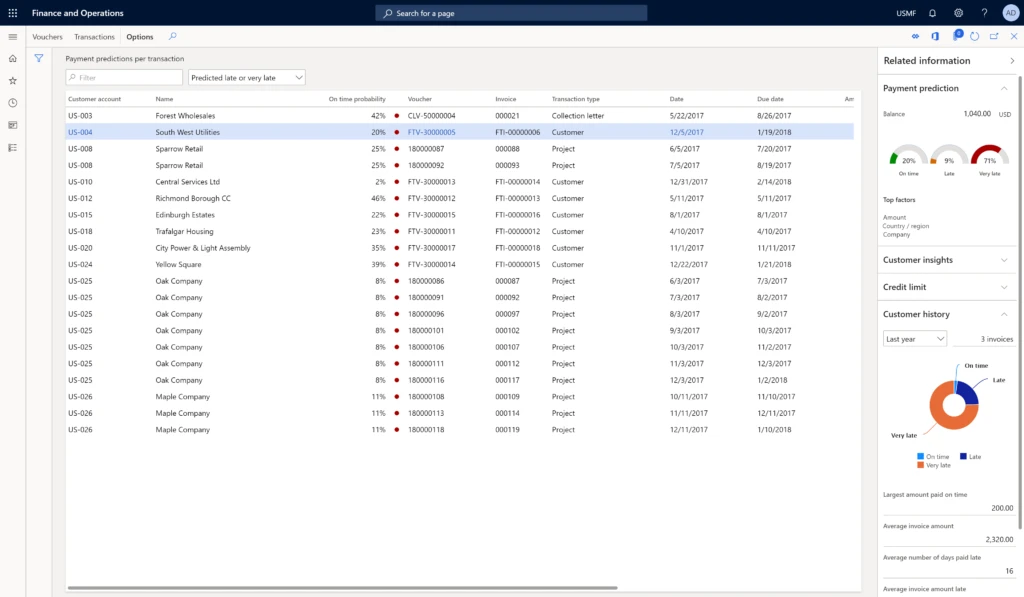

Reliably predict customer payments

Late or missed payments can have a significant impact on day sales outstanding (DSO) and your collections management process as a whole. Typically, little is known about customer payments in advance, and sizeable amounts of effort are spent trying to identify at-risk payments and reactively initiating collections processes when necessary.

Finance Insights will allow you to accurately predict when customers will pay their invoices, provide immediate visibility into the probability of late or at-risk payments, and enable you to act to reduce write-offs and improve margins through proactive and automated collections.

Adapt quickly with intelligent budget proposals

Creating a budget has traditionally been a manual, repetitive, and relatively slow process. Budget creators spend a high percentage of their time stitching together data from an array of sources and discussing the quality of information going into the proposed numbers.

By using Finance Insights, intelligent budget proposals can quickly consolidate and analyze years of historical data to predict your budget forecast. By letting the system perform these budgeting tasks for you, you’ll save time and be able to focus on meaningful discussions about how the budget will support your business.

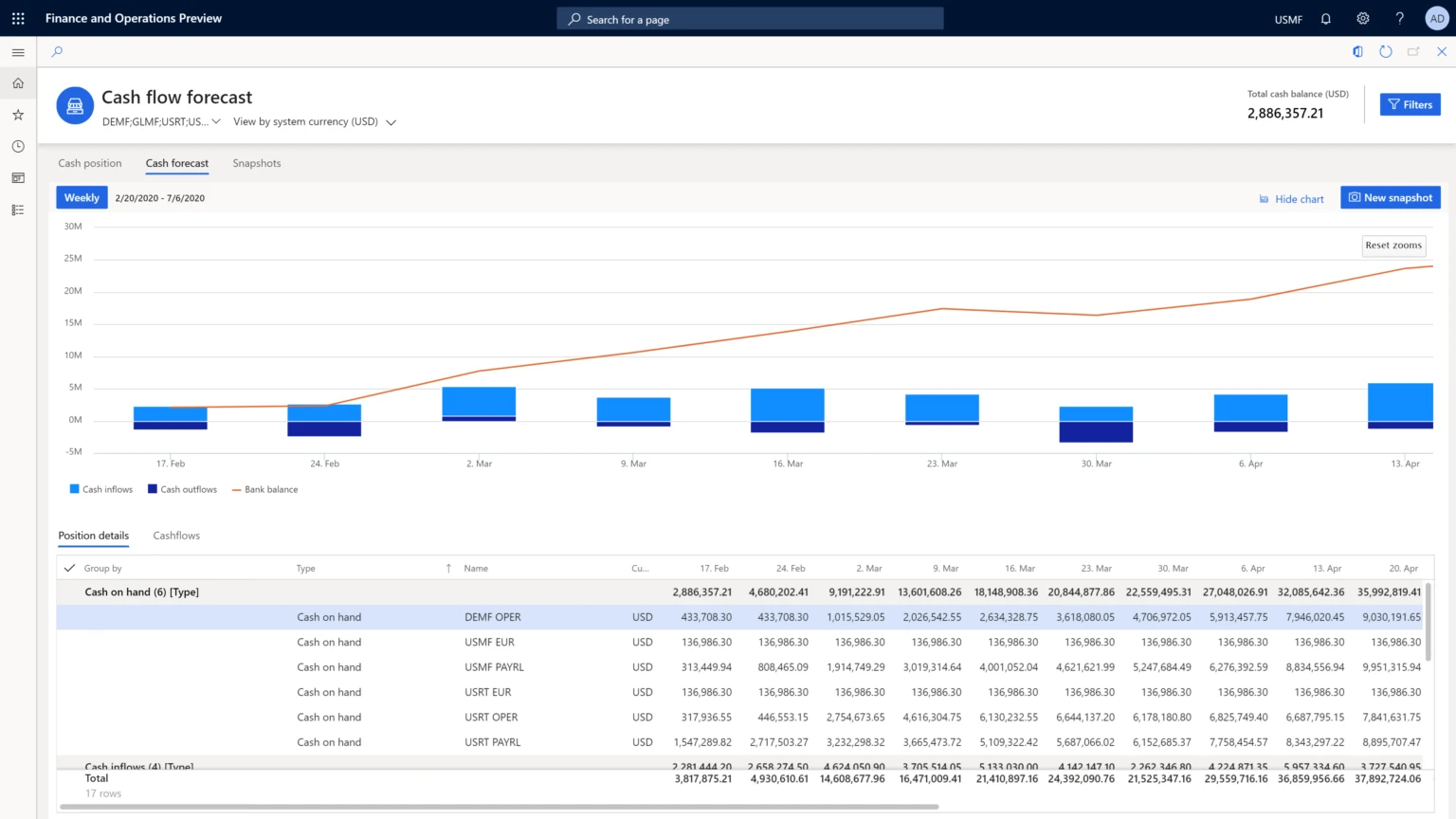

Increase accuracy of projected cash flow

Cash flow forecasting is a tedious, repetitive process that often leads to untimely results. Data sits in silos across enterprise resource planning (ERP) systems and financial planning software and spreadsheets, and in many cases, institutional knowledge is relied upon to pull together information and develop a forecast. This results in a commonly inaccurate forecast, assuming an organization is even able to measure results once financials are realized.

AI-powered capabilities in Finance Insights will significantly improve this process. Users can automatically integrate data from external systems and reports, eliminating data silos. The use of time-series forecasting and customer payment predictions will improve overall accuracy. The ability to save cash flow forecasts and compare them against actual financial results will enable you to measure forecast performance and prepare accurate forecasts in the future. Finance Insights transforms tedious, repetitive, spreadsheet-based processes into an intelligent, automated solution.

Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner with offices all over GCC (Bahrain, Saudi Arabia KSA, Oman “Muscat”, UAE “Dubai”, and Kuwait), with domain expertise in Financial Services Sector Digital Transformation like” Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking.