A variety of factors, including the pressure to reduce costs and satisfy customers while remaining competitive and agile, are altering the modern financial services landscape. Leading banks and financial firms have widely accepted digital transformation as an imperative to set their businesses up for long-term success and keep up with evolving industry trends. In recent years, banks, capital market firms, and insurance agencies have started using robotic process automation (RPA) to optimize costs and help streamline high-volume workflows previously burdened by manual repetitive processes.

Today, financial services institutions (FSIs) are exploring ways to further enhance RPA-enables processes with artificial intelligence (AI). When combined, RPA and AI technologies help FSIs improve operational efficiency, develop innovative products and services, transform their customer experience, minimize risk, and personalize offerings in a compliant manner.

Amplifying business value by creating systems of intelligence

FSIs are eager to build on the success of early RPA initiatives and business leaders are rapidly turning to AI technologies including machine learning to further enhance and transform their business processes. The innovative combination of RPA and AI technologies built on Azure—known as intelligent automation—offers institutions an opportunity to immediately add the intelligence which fundamentally changes the way they run their day-to-day operations, manage their data, and interact with their customers.

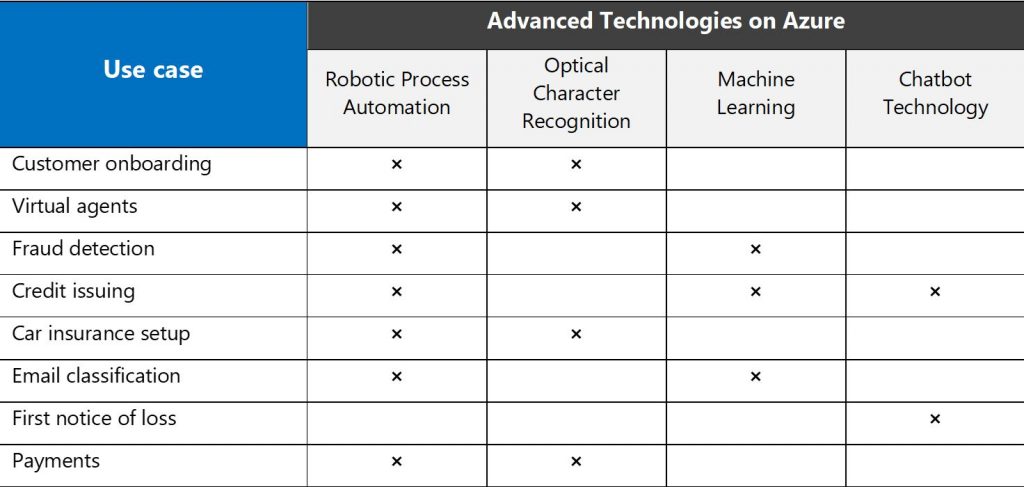

Bundling the capabilities of RPA software with Azure’s AI platform technologies such as machine learning, advanced analytics, cognitive services, and intelligent bots is the core of intelligent banking. These advanced offerings impact numerous use cases in financial services environments:

- Combining Optical Character Recognition (OCR) and RPA empowers banks to automate a variety of processes including customer onboarding, payment processing, automotive insurance setup, and many customer service tasks

- Pairing RPA with machine learning helps financial institutions to create more intelligent processes for credit issuing, fraud detection, and email classification

- Adding chatbot technologies to these bundles helps banks develop customer-friendly workflows for many processes including issuing credit and loss notifications

Intelligent automation applications help drive levels of operational optimization that would otherwise be impossible to attain. And the value doesn’t stop there—these newfound efficiencies also reduce organizational costs and free up capital to invest in delivering better customer experiences.

Analysts estimate AI alone will save the banking industry more than $1 trillion and create a 22% cost reduction, with most savings coming from the front office. Considering 41% of consumers report being willing to change banks if offered more personalized services, having the extra capital to invest in a differentiated client experience is as important as it has ever been. Microsoft’s AI Platform combined with existing RPA solutions built on Azure transforms the way banks personalize financial services, interact with customers, and optimize operations.

Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner with offices all over GCC (Bahrain, Saudi Arabia KSA, Oman “Muscat”, UAE “Dubai”, and Kuwait), with domain expertise in Financial Services Sector Digital Transformation like” Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking.