As the spectrum & volume of Digital Transactions is increasing exponentially and further boosted by pandemic-like scenarios, the Regulators of the Financial institutes across the Globe are tightening all possible controls such as Anti Money Laundering (AML) to minimize the ever-increasing threat of financial terrorism & malafide intentions. Financial Institutes are embracing the systems, procedures & effective implementation of tools such as CRM to nullify this and comply with the regulations.

Traditional AML regulations primarily are the rule-based system to track & notify suspicious activity. As the Financial institutes are going global & covering better service horizons, resulting in a higher number of false positives. With the evolution of Digitization, AML solutions need to be more agile, leveraging technology upgrades (such as AI-based AML solutions) to cover optimum scenarios with greater efficiency.

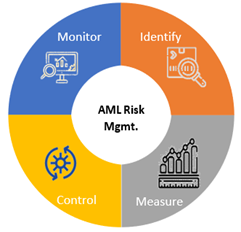

AML recommends 4 key areas to focus

- KYC / eKYC – This is the very first and very critical step of the AML Program. Physical KYC quantum will reduce as Digitization is extended to Onboarding. During eKYC the digital identity of the customer is recorded which has some limitations so options like Video KYC are widely getting adopted for authenticity. In some countries, CKYC (Central KYC) which is a central repository is also referred to.

- Customer Due Diligence (CDD) – This comprises of Risk assessment of the new customer for potential money laundering or terrorist financing risk. Customer information is checked and screened against several online databases, including politically exposed persons (PEPs), government records, watchlists, and sanctions screening.

- Transaction Monitoring – Every financial transaction between 2 accounts needs to be monitored and controlled. Even a single ignorance or inability of the AML tool directly affects the image & reputation of the Bank. AML policies enforce notifying of every transaction not complying with the defined limits.

- Suspicious Activity Reporting – Even a mid-size bank or a financial institute envisages thousands of financial transactions in the day via direct or indirect customers. In case of an incidence, the availability of a system-generated Audit Trail is vital to help law enforcement trace a crime to its originators. In such cases the time is a crucial element, instant action is a must.

AML Compliance program envisages the business and customer profile of the financial institute. Accordingly review of the institution’s business, customers, and transactions to identify areas with high potential for exposure to money laundering. Risk management requires identifying, measuring, control and monitoring money laundering risk effectively.

New AML Guideline across the Globe

In the US, the new AML law has made some sweeping changes to the Bank Secrecy Act and other AML rules, such as the introduction of new beneficial ownership requirements, the addition of virtual currencies in the AML framework, mandatory Suspicious Activity Reporting (SAR) requirements, and expanded civil penalties for the violators of the AMLA.

In UAE, Central Bank mandated the reporting of suspicious activities and the development of robust AML programs to minimize the risks of money laundering and terrorist financing. Following this move, Dubai set up a specialized court for combating money laundering challenges, while the National Committee for Combatting Money-Laundering and Financing of Terrorism and Illegal Organisations (NAMLCFTC) introduced new regulatory requirements for virtual asset providers in September 2021. Under the new AML framework, all virtual currency providers including cryptocurrencies have been obligated to comply with the FATF’s travel rule.

A Crucial Phase of AML is KYC, well driven by CRM tool

Entire AML software is driven by data. Banks and Financial institutes are turning to manage this internal data volume but it is also mandatory to screen against several online databases, including politically exposed persons (PEPs), government records, watchlists, and sanctions screening. Once Customer demographics are collected and verified, they can be integrated into enterprise systems like CRM to:

- streamline the customer onboarding process

- conduct further due diligence and risk assessment

- review for PEPs (Politically Exposed Persons)

This is how CRM software embraced by the Bank or Financial institute can offer high-quality customer intelligence, a CRM can become one of the pillars of a KYC strategy.

Especially in recent pandemic scenarios, the CRM software automated the process by capturing the data received from Online Web Forms sent over email to customers and updating it into KYC Database without any manual intervention. This has not only widened the acceptance from CRM and KYC automation but has also saved operational costs for KYC follow-ups over the telephone.

AML software is a cost to the Bank and more features will further add to the commercials but it is mandatory and it is a reputational risk for the Bank which is much lesser than the software cost.

Banks are aggressively implementing CRM and integrating with eKYC and Core Banking solutions to create, maintain, comply with a single Data Repository.

Today, Data is costlier than Oil. If the CRM is configured and integrated it can do excellent value add for the AML compliance and at the same time, it can generate multiple cross-selling and up-selling opportunities for the Sales team so that the cost associated with AML implementation can very well be justified.

Image Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar).

Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.