Customer Relationship Management (CRM) is a buzzword today, across the industry and precisely in Banking. Customers across the globe, have fully embraced the Digital evolution in Banking. More than 60-70% of customers do not visit the Bank, yet enjoy various Banking services through the Digital touchpoints offered such as Smart Phone, ATMs, Internet Banking, Digital branch, etc. With the latest innovations in technology, customer expectations are increasing so banks need to adopt a modern, customer-focused approach to service customers, best possible with the adoption of a CRM software

In earlier days, customers used to bank with 2-3 banks utmost, primarily due to limited products & services offered by the bank. Nowadays, every customer has relationships with multiple banks, and the Banks also, apart from traditional banking, do offer other financial services to cover the entire financial paradigm of a customer (such as Investments, Insurance, Trading, etc.) under one roof to increase customer stickiness and satisfaction. The scenario underlines the importance of CRM software.

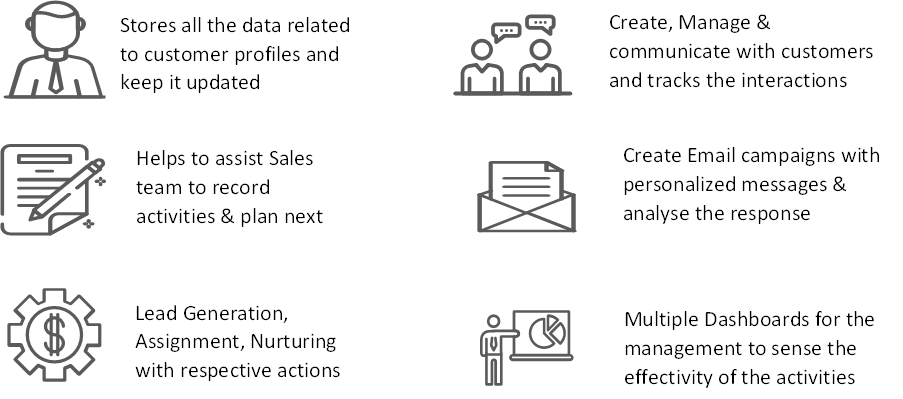

What a CRM software can do for a Bank?

Data is costlier than Oil and effective use of it yields many vital inputs and is actionable for the Sales and marketing team of the bank. CRM Software uses the Data to facilitate customer-focused strategies to create ‘Bank of Choice’ feelings among the customer.

AI/ML inclusion in CRM

Latest technology innovation based on AI/ML such as predictive analysis, behavioral analysis, Patter analysis triggers multiple opportunities which proactively create a future Sales pipeline that the Sales team can focus on. Additionally, these algorithms also generate reports, dashboards that report customer satisfaction index, eye-openers & future trends.

Inputs to Create a Customer-Centric Model is a great outcome of such algorithms. Predictive data to launch a new service/product is a key requirement.

CRM is an engine for Sales & Marketing @ Banks

CRM software can mirror out where we are and equally depict the potential areas/services/sectors based on customer requirements that trigger the required transformation. As per the reports, Accenture found that 67% are willing to provide more information to banks if it means they will receive new benefits and 71% said they would use entirely computer-generated support for their banking processes.

This Data captured by CRM can drive and assist existing marketing & sales activities in a properly directed way with multiple such benefits.

1. Penetration Analysis

Banks are offering other financial services such as Insurance, Investments, etc. Most of the time, studies have revealed that around 80% of customers do use only 20% of the products/services of the Bank. CRM software well integrated with CBS and other services can get a comprehensive view and better insights that will generate huge opportunities for the Bank.

2. We are Listening to you

Many times customers do share about their plans and requirements over the counter or at external touch-points such as ATMs. Integration of these leads with CRM ensured the lead enters into the Sales cycle. More importantly, customers get the feeling that this Bank is Listening to me and the lead conversion optimizes. Customer stickiness increases which have a straight impact on Bank profit.

3. Addressing the Sentiments

Today customer does not have time to express his dissatisfaction with any incidence/service. He will simply switch to the better option available. CRM can add a great value to identify and address such sentiments of the customer by capturing the data or understanding his declining relationship with the bank.

4. Enhanced Productivity

Since CRM consolidates all the peer systems with the core to offer a single comprehensive view of a customer, bank employee saves his time in spends in mundane tasks of cross-referencing.

5. Effective Marketing & Sales

Key CRM features such as tracking, alerting, forecasting, automating routine processes & reports, etc. offer great support for the Sales and Marketing team allows them to focus on key activities for better results.

6. Management Tracker

Effectively implemented CRM system offers a complete 360° view of the entire cycle along with customer sense. The Dashboard & reports reflect the efficiency of the team which can trigger the corrective actions if any.

7. Increasing Customer Satisfaction

If a customer gets a quick response, fast actions, and timely disbursements, he will not only be your happy customer, but he is also your Sales Manager which would be highly effective.

In the current competitive age, Banks are leveraging these CRM benefits for optimizing their cost centers, better customer relationship management (especially for digital customers), and productive use of the customer data for quick and better cross-selling / up-selling.

Image Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar).

Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.