Today as banking is getting boundary-less, the lending world is extremely competitive. Banks and Financial Institutes have adopted CRM systems for Customer Relationship Management, Lead nurturing & Customer Profiling. These CRM systems capture customer data of an individual or an enterprise. Moreover, real-time data feeds keep data updated for quick and informed decisions that help them to manage their time profitably. Integration with standard Credit Scoring agencies further simplifies the process of profiling including the probable risks to make intelligent automated credit and lending decisions. This active integration with Credit Scoring keeps the accuracy of data, saving precious time and resources.

This also minimizes the mundane jobs like Data Entry and utilizes the resources for the Core activities.

As mentioned earlier CRMs empowered with AI/ML technology, provides supporting analysis in due course which helps to identify and mitigate risks that may occur.

Pre-Approved loans campaign can be easily and reliably executed in an automated way using a CRM system that captures Customer leads and based on the Credit Score/Rating, supporting documents uploaded can directly initiate the loan approval process and disburse the same.

On the other hand, these informed decisions and profiling make the entire credit process more effective. Especially as the Banks & Financial Institutes expand in new unknown geographies, this process minimizes the risk associated and functions equally strong.

During the Pandemic situations and post Pandemic situations, when individuals & even most of the business units would need instant credit facilities to get back to routine, the CRMs empowered with integrated Credit Scores & real-time feeds about respective profiles would tune the process to make it more reliable.

Credit Scoring for Quick, Easy & Reliable Lending

Data is a new Oil but the right use of it at right time can make it effective & simpler, be it a Financial institute (FI) or an Individual. In today’s digital world, since most of the customer data is available in digital form, many processes have been simplified and so has the lending process at FIs. Every customer that applies for a loan, needs it as of yesterday. FIs do sense this urgency and are making every possible attempt to reduce Turn-Around-Time (TAT). The prime decision factor for the sanctioning is the Credit Score of the customer. Credit scores determine a person’s ability to borrow money and this works as a guide for FIs to take the right decision.

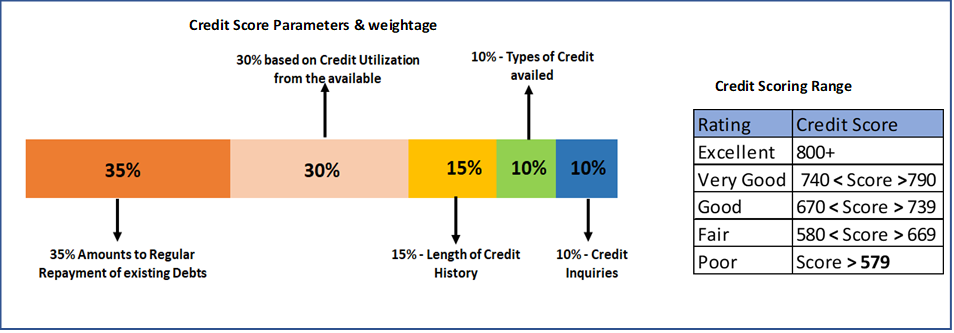

As we all know, a credit score is primarily computed on regular repayment of existing debts, Credit utilization, credit history & no. of credit inquiries as mentioned in the figure below.

A credit score of an individual is a number between 300 and 850, with 850 being the highest score possible. For Corporates & Enterprises, a separate Credit Rating model is used which depends on various parameters such as Company information, Historical business data, Payment history and collections, Number of accounts reporting and details, etc.

As per the guidelines released by the World Bank, Credit Scoring is a valuable tool for improving financial inclusion; credit access for individuals and micro, small, and medium enterprises; and efficiency. The use of credit scoring and the variety of scoring have increased significantly in recent years owing to better access to a wider variety of data, increased computing power, greater demand for efficiency improvements, and economic growth. The application of credit scoring has evolved from the traditional decision making of accepting or rejecting an application for credit to the inclusion of other facets of the credit process such as the pricing of financial services to reflect the risk profile of the consumer or business and the setting of credit limits. Credit scoring is also used to determine minimum levels of regulatory and economic capital, support customer relationship management, and, in certain countries, solicit prospective consumers and businesses with offers.

Earlier the credit scoring was largely based on the Financial and Operational data available and the associated statistical equations. But the recent dynamic situations demand further sophistication in the same using latest technology trends such as artificial intelligence, including machine learning algorithms such as random forests, gradient boosting, and deep neural networks.

As mentioned earlier, as more & more digital data is available, the adoption of innovative techniques has also broadened the range of data that may be considered relevant for credit scoring models and decisions.

It is imperative that effective Credit Scoring can trigger faster TATs and Quality advances proposals getting processed quickly with the help of CRM

Image Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar).

Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.