At its core, the Financial Services industry facilitates the trusted exchange of value across multiple, untrusting parties. Brokering that trusted exchange carries enormous responsibility and significant risk. For this reason, financial institutions (FIs) rely on costly third parties, manual audits, and time-intensive reconciliations to manage risk and satisfy regulatory requirements. Today, more FIs are looking to blockchain to streamline cross-organizational collaboration, remove the need for error-prone audits, and create transformative business models using real-time customer insights. By utilizing the Azure Blockchain to broker trust, FIs mitigate risk, reduce costs, and improve customer outcomes.

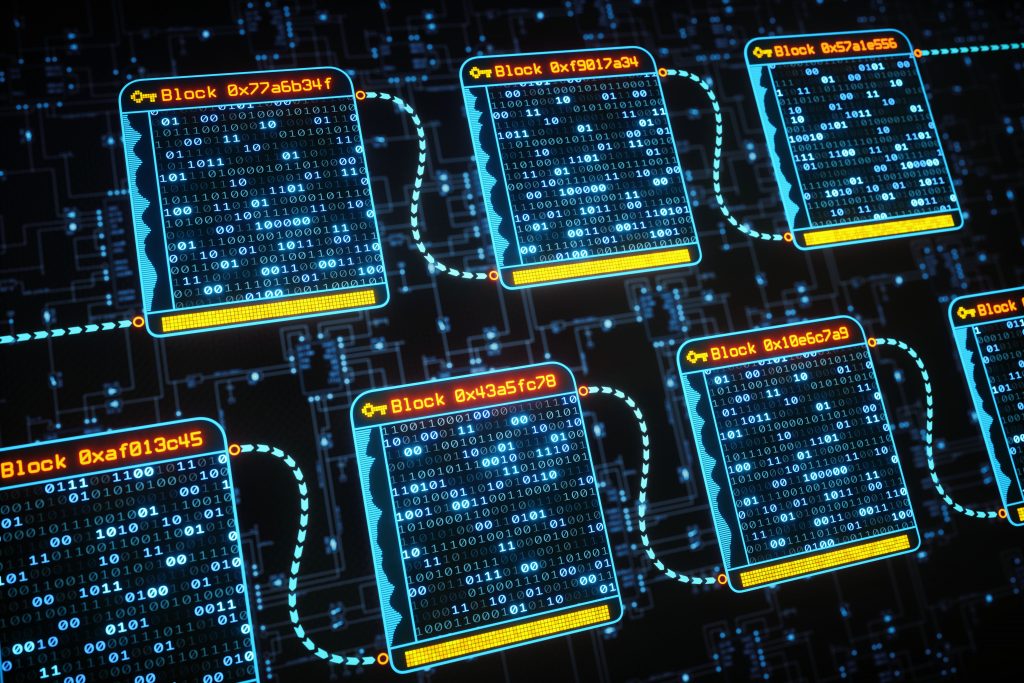

What is blockchain?

Initially popularized as the foundation for digital currencies like Bitcoin, blockchain’s combination of distributed systems and cryptography enabled the near-immediate transfer of value between counterparties with an immutable record written to a shared ledger. While early ledgers were limited to facilitating “spot” transactions, more enterprise-focused technologies like Quorum and Corda soon enabled users to set the terms under which value would be transferred at a future point in time, through smart contracts.

For FIs, this new data structure provides a distributed, immutable record to manage the trade and settlement of the digital assets they finance, transfer, securitize and insure.

Blockchain for FIs

While the surface area of blockchain is vast, we’ve found that FIs are increasingly interested in digital asset transfer scenarios. Depending on its role, an FI may have several touchpoints along the custodial chain of a digital asset:

- Digital asset creation and issuance: Retail and commercial banks alike are using blockchain to track everything from the provenance and performance of underlying debt for collateralized debt obligations (CDOs), to the flows of physical commodities that make up their securities.

- Financing: Commercial banks responsible for extending credit for asset purchases look to streamline cumbersome trade finance processes, exchanging data between corporate customers, KYC and credit data providers on a common data structure.

- Trade and post-trade settlement: Exchanges and clearinghouses are translating trade logic into smart contracts to efficiently transfer digital asset across parties. Smart contracts confirm ownership and trade terms as part of an immutable audit log on the blockchain.

- Asset insurance and claims processing: Insurers are working with banks and corporate customers to codify the terms of their policies and more accurately collect and attest the data pertinent to the premium setting process. Sharing this information, immutably, on the ledger, allows insurers to adjust premiums considering new information. This frees up capital for corporate customers, while reducing the burden of claims processing and reconciliations for insurers.

- Regulatory compliance: Banks are securing and automating compliance processes that draw from undisputable data sources – reducing both the cost and risk of error when auditing compliance with regulations.

Incorporating blockchain into your business

Although blockchain provides transformative capabilities for financial services, FIs still have to figure out how to scale to production and integrate with existing workflows. Building a foundation to manage, govern, and grow a functional blockchain network is a huge undertaking, requiring heavy ongoing resource investments. The security and scalability of Azure enable banks to create impactful blockchain solutions and manage and govern networks at scale.

Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar).

Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.