The volume of Digital/Online transactions is increasing exponentially, due to instant and ease-of-doing features offered by digital platforms such as UPI & Mobile Banking. Financial institutes are also encouraging an online mode to optimize per transaction cost. But online frauds threat is a probable show-stopper & this is getting nullified to a large extent with the adoption of Biometric Authentication.

The security of these digital platforms is getting enhanced with the introduction of Biometric which easily ensures proof of identity for precise authentication which is a key concern of all financial institutes and the customers.

As Mobile Banking, UPI technologies evolved and the internet gets cheaper, a trend is getting set for Digital Transactions replacing physical visits to the financial institutes. This increasing trend was hit hard by hackers, primarily due to limitations of traditional authentication techniques such as passwords, OTP, etc.

The biggest success of Biometric is largely due to its ability to address the challenges arising out of Data leaks, weak credentials & user awareness

As the ‘Go-Digital’ trend is widely adopted, sanctity is the key concern at both ends. Traditional authentications do not provide the details of who is executing the transaction on the other end, rather it solely depends on the security extended by the Financial Institute and the security framework available at the other end.

Evolution of Biometric authentication

As said, biometrics was first experimented with way back in 500BC in the Babylonian empire. The first record of a biometric identification system was in the 1800s, Paris, France. Alphonse Bertillon developed a method of specific body measurements for the classification and comparison of criminals. While this system was far from perfect, it got the ball rolling on using unique biological characteristics to authenticate identity.

Fingerprinting followed suit in the 1880s, not only as a means of identifying criminals but also as a form of signature on contracts. It was recognized that a fingerprint was symbolic of a person’s identity and one could be held accountable by it. Though there are debates on who exactly instigated fingerprinting for identification, Edward Henry is denoted for the development of a fingerprinting standard called the Henry Classification System. (Source bioconnect.com)

Over the decades, there were hundreds of experiments on this technology exploring Fingerprint, Iris, Facial recognition as biometric authentication. Criminal identification, Law enforcement was the typical initial use cases.

Today, almost every smartphone is Biometric enabled and most of the Apps do authenticate on this. This feature was first introduced by Apple in 2013 in their smartphone for individual authentication.

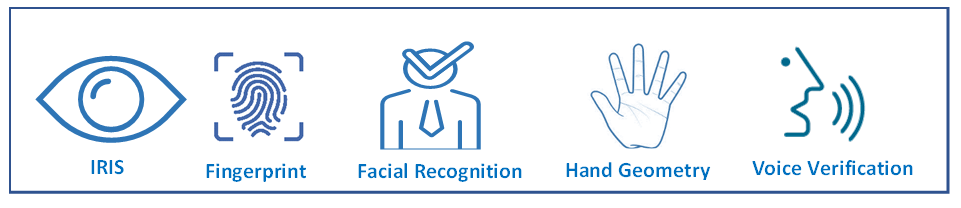

Biometric Techniques

The authorities say “no two people have ever been found to have the same fingerprints, not even the twins”. Similarly, the other biometrics which offers equal unique characteristics makes the security (unlocking a system, allowing access, approving a transaction) more authentic, reliable, and precisely with less friction for the user.

The iris is the colored tissue surrounding the pupil of the eye and is composed of intricate patterns with many furrows and ridges.

Retina-based identification is perceived as the most secure method of authenticating identity.

Behavioral Biometrics consists of measurements taken from the user’s actions, some of them indirectly measured from the human body.

Voice verification systems are different from voice recognition systems, voice verification is recognizing who is saying it.

Though 100% of accuracy cannot be achieved, certain performance thresholds are defined to consider reliable biometric technology. Typically for higher accuracy >90%, fingerprint, iris, retinal are widely used.

Mutually beneficial Biometric authentication

Yes, the reason for global & wider acceptance of biometric is primarily due to its mutually beneficial properties. While the Financial institutes are integrating this for enhanced security, the customer on the other end gets the feel of a more authentic & reliable option.

- Highly Secure

- Convenient & Fast

- Unique to a Person

- Non-Transferable

- Spoof proof

- Cost-effective

Future of Biometrics

Biometric empowers safe & secured transactions with unmatched algorithms. You are authorizing your own identity, this is a great & convincing feeling for the customer. With mutual comfort, Financial institutes are exploring the options of Cardless ATMs, Hassle-free & timely KYC, High-Value Trading, Critical Access Control, and many more. The adoption will extend beyond banking, financial institutes, Airport authorities to all those verticals where personal identification is required.

Image Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar). Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.