Over the last 2 decades and to be precise, after Y2K, the technology is emerging at an exponential rate. Especially we are witnessing a transformation of the Role of IT in a Financial Institute from a Facilitator (facilitates Core Business multiple technology innovations that help Business to grow) to a Business Driver i.e., now the technology status/readiness/vision of a Financial Institute is directly impacting key business parameters. The Digitization Index of an organization will have a vital impact on Business penetration, Growth strategies, Customer acquisition, and stickiness. Today, on the verge of the Open Banking revolution, the acceptance & adoption of the technology right from ‘C Level’ down the line will impact the sustenance in the market.

Recently, during the pandemic, it was experienced and witnessed widely that the Organizations with affirmative acceptance on “Go-Digital” could operate seamlessly with maximum uptime and uninterrupted BCPs.

So, what could be the Start Point for Digitization?

Most of the financial institutes started with digitalization from back-office processes, it does contribute to a large extent on cost savings, it in terms of business impact, it could not score much.

But for enhanced Customer experience, it is expected that the Organizations should extend the benefits of ‘The Digital Way’ as a USP of its Customer acquisition strategy.

Customer Onboarding, the start of the Digital Journey

In the competition landscape & exceptional scenarios such as a pandemic, to acquire new customers instantly, the onboarding process has to be

1. Quick, Simple & Secure – Time is a challenge, Simplicity is an ask and Security is the need of the hour. This assurance will prove to be very effective and appealing for the new customer acquisition.

2. Available 24x7x365 – Emerging technology can empower service availability round the clock for the customers. The service uptime is now a credential of an Organization.

3. Technology Enablement – Customer wants to access through a touchpoint of his choice & interest. The adoption of cutting-edge technology can extend multiple touchpoints and the power of Automation also ensures minimal manpower requirements.

Benefits of effective Customer Onboarding through Digital Channels

Financial institutes have to imbibe & extend the technology benefits to prospects. The process needs to be automated/digitized and fine-tuned with technology upgrades.

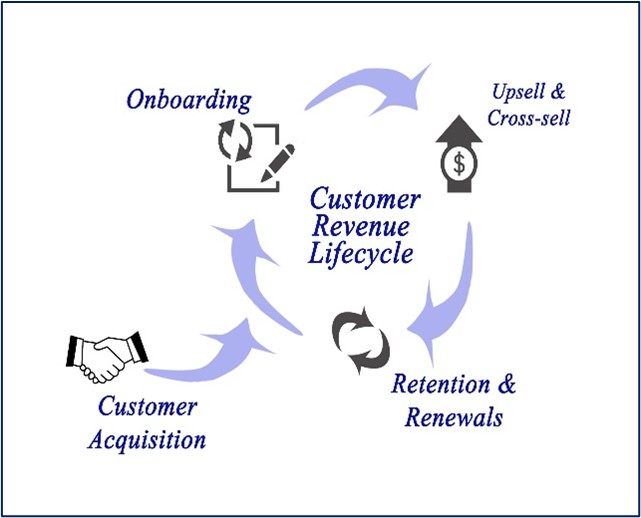

1. An Effective Onboarding – a process not only enables Customer Acquisition but also accelerates & opens all other service offerings for better Cross-selling/up-selling possibilities. Even the periodic activities such as renewals, retentions will be enhanced to offer a better customer experience.

2. KYC Activities simplified – The regulators of respective regions insist KYC Compliance with proper DD (Due Diligence) which is part of Onboarding. The latest technology features take the feed from respective National Identity Authorities to make it quick, digitized & authentic.

3. Cost Optimization – Today, the Regulators have enforced a set of activities before onboarding a customer. Following the traditional approach working out to be the costlier option. The Digital way offers more flexibility with cost-effective features.

Scope and latest Trends in Customer Onboarding

To Minimize operational burden and ensure compliance, adoption of the latest trends in technology becomes mandatory for Organizations.

Typically, the Core Systems are designed to embed the On-boarding process including the KYC process but with emerging trends, extended requirements & external touchpoints such as Tab-Banking some external plug-ins are introduced to suffice the requirements. These plug-ins are self-driven (can be executed by the customer himself).

The emergence of government-backed data sources has made customer onboarding swift and continues to do so. The establishment of public registers for users’ data has helped reduce the need for physical documents and detect irregularities that may be present in the data provided by the applicant.

Image Source: https://cloudblogs.microsoft.com/

Global iTS is a leading Microsoft Dynamics 365 ERP and CRM Partner, headquartered in the UK. With 300+ clients, successfully proven implementations, an excellent support system by our experienced domain specialist, and a good track record of customer retention. Also, it has a strong foothold and customer base across other GCC countries (Bahrain, Saudi Arabia, Oman, Kuwait, UAE, and Qatar).

Global iTS is mainly into the specialized requirements in Financial Services and Insurance sectors focusing on Digital Transformation journey in Retail Banking, Commercial Banking, Insurance Providers, Private Equity, and Investment Banking by bringing Artificial Intelligence, Machine Learning, Blockchain, and Robotic Process Automation technologies and enhanced their productivity and profitability. We bring in over 15 years of international expertise to digitally transform any aspect of a client’s business.